Steve Brown, Real Estate Editor

Dallas News

Dallas-Fort Worth tops the list of U.S. cities that real estate industry execs say will be the best for their business in 2019.

D-FW has been rated the highest for property investment and construction in a closely watched real estate beauty contest — the annual Emerging Trends in Real Estate report, which polled industry leaders on their outlook for 79 U.S. cities. The last time D-FW topped the list was in 2015, in the report looking ahead to 2016.

"I'm thrilled to see Dallas at the top of the list again," said Byron Carlock, national real estate leader with PriceWaterhouseCoopers, which, with the Urban Land Institute, sponsors the annual survey. "Dallas is doing a lot of things right.

"Dallas is one of the bright spots in our country," Carlock said. "We are watching Dallas lead the way among major cities pivoting to the new economy."

The recent strongest U.S. market for both job growth and population gains, D-FW is the top home and apartment building center in the country and a leader in demand for all kinds of commercial real estate. In just the first half of 2018, more than $11 billion in construction projects were started in North Texas. Only New York City had more total building.

Austin and San Antonio also placed among the Emerging Trends report's 20 favorite cities for investment and development in 2019.

Seventeen of the 20 cities are considered "secondary" markets — as opposed to the big "gateway" locations such as New York, San Francisco and Washington, D.C., that are usually favored by investors.

Along with D-FW, the cities investors like most for next year include Raleigh-Durham, N.C.; Orlando, Fla.; Nashville; and Charlotte, N.C.

"More job growth is happening in those markets," said Urban Land Institute's global CEO, Ed Walter. "And the amount of investment [capital] that has flowed into the gateway markets has in a lot of cases created some imbalances."

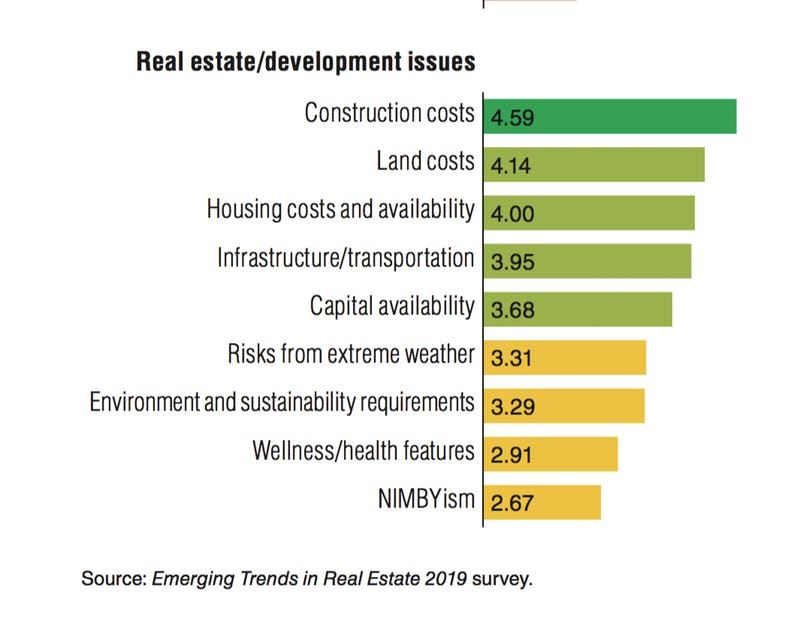

Some of the biggest issues in the real estate industry for next year.

Walter said Dallas-Fort Worth is a prime example of one of fast-growth, non-coastal metro areas.

"The five-year growth rate of Dallas for employment is more than double the national average," he said. "When you add up all the different ingredients, Dallas ends up ranking as the best market over the near term."

More than 2,300 property owners, lenders, brokers, investors, builders and other property professionals were polled for their outlook on the U.S. real estate market.

This is the 40th year that the Emerging Trends report has been published. Real estate execs were asked to rank their favorite property types for next year — industrial buildings, garden apartments and shopping center redevelopments. Chief industry worries for the coming year were also highlighted.

The top concerns for 2019 include:

*Rising interest rates, which are at the highest level in more than five years.

*Higher property insurance costs, because of climate change and expensive storms and fires, which are raising policy premiums.

*Immigration restrictions, which could cause "negative economic consequences and long-term weakening of our national growth potential" and lead to further labor shortages.

*The long real estate cycle, which means a future downturn is more likely. "The decline in real estate transaction volume seems to say that investors as a group are pulling back in the face of such concerns."

So far, there's no sign of oversupply in most of the country's cities, Walter said. "What's been different about this cycle compared to the others is that supply growth has generally been constrained."

PwC's Carlock said only a tiny percentage of the property professionals surveyed were negative about 2019.

"As you look at supply-demand characteristics and the disciplined approach to the market and the amount of equity going into deals, we have a fairly healthy industry," he said.

D-FW heads the list of the U.S. cities with the best property market prospects for next year, according to the Emerging Trends in Real Estate report.

View online